- #W9 free form filler how to

- #W9 free form filler pdf

- #W9 free form filler full

- #W9 free form filler software

- #W9 free form filler code

#W9 free form filler pdf

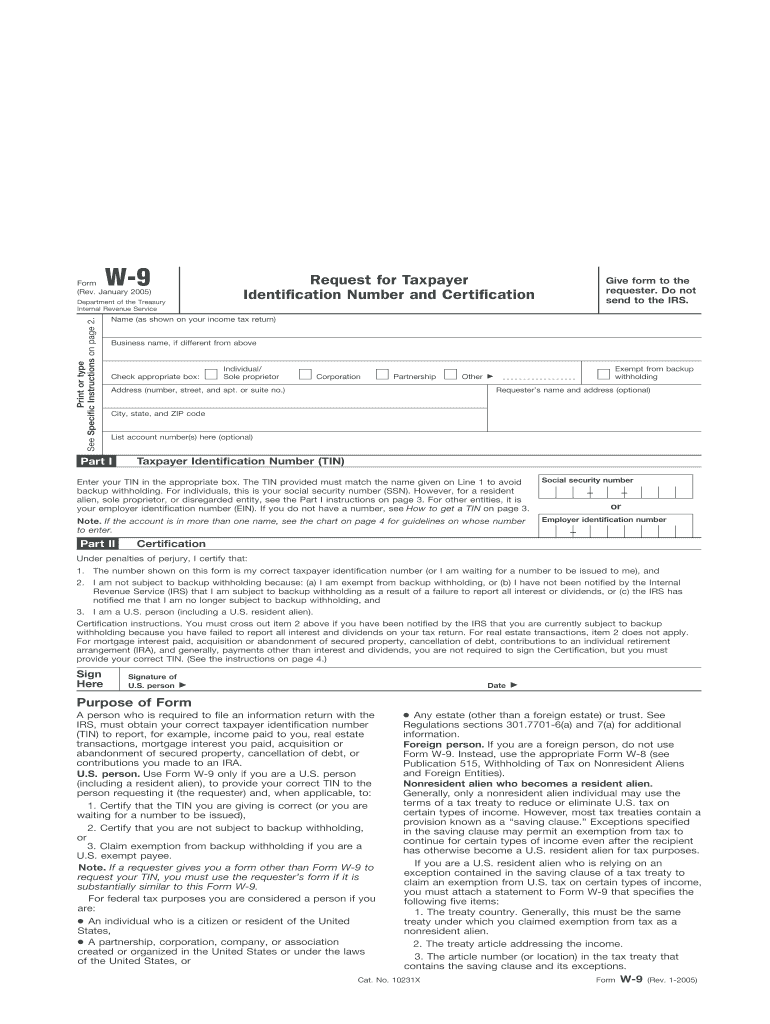

( you can password protect PDF and email PDF with EaseUS PDF editing program) If not, add a password to your PDF document and email it securely to the requester. Make sure that the name, address, SSN, EIN are completely correct, or you may pay a high price for the mistake you made.Thus, to help you avoid some common mistakes, we list some general instructions below:

When you finish all the items above, sign and date your W-9 form in Part II – Certification.įilling out the W-9 is very important for your taxpayer. Note: Check the information you entered because a wrong TIN will cause issues with your payments or tax return or lead to the backup withholding later. In the Part I, enter your Social Security number (SSN) or your employer identification number (EIN) according to your situation. Usually, most individuals leave it blank. Then for the following line – Account number(s), it is an optional line where you can choose to fill in or not. Type the address where the request of the W-9 form will mail your information returns to.

#W9 free form filler code

If you are exempt from backup withholding, enter the exemption code that applies to you. If you are an individual, you can leave this line blank. Confirm what type of business entity you are for federal tax classification: sole proprietorship, S Corporation, C Corporation, Limited Liability Company trust/estate, or "other". If you don't have a business name, you can leave this line blank. Write your business name in line 2 if it is different from the name you entered above.

#W9 free form filler full

Type your full name in line 1, and it should match the name on your individual tax return. Next, download and launch EaseUS PDF form filler to open the W-9 form. Download the latest W-9 form from the IRS website, and check the date in the top left corner of the form because it is updated occasionally.

#W9 free form filler how to

Now let's jump into how to fill the IRS W-9 form with this powerful Windows PDF editing software:

#W9 free form filler software

Moreover, this software also provides many basic and advanced editing tools to enrich and manage your PDF documents as you like. It enables you to add or search some certain text, change fonts size and color, and add date and signature to your PDF forms quickly. With this PDF form filler's help, you are able to fill in or out all your PDF forms without any hassle. Here we recommend EaseUS PDF Editor first, which makes your whole working process easier and easier. Related post: How to fill out PDF form How to Fill Out a W9 Form Correctly and Completelyīefore filling out the W-9 form, you need to find an easy yet powerful PDF editor. Generally speaking, freelancers, professional consultants, trade workers, and independent contractors are required to fill out this form. So these kinds of people need to fill out a W-9 form. W-9 is the form used by the IRS to help gather information about these independent contractors or freelancers, consultants, etc. Also, it can serve as a guide in completing a contractor's tax obligations for the calendar year. It is used by independent contractors and other self-employed workers, indicating that the taxpayer is not subject to backup withholding and is responsible for paying his own taxes.

So, in the following, you are going to know the below information: What is a W-9 Form Used for?Ī W-9 form is a tax form used by employers to identify their employees. Things You Need to Know About W9 Form Before Fillingīefore filling out the W-9 form, you need to learn more about the W-9 form to do the task correctly and completely.

0 kommentar(er)

0 kommentar(er)